Note: Let’s get something out of the way before we start. This piece is about illegal immigration. It rests on the understanding that there are legal and illegal means of entering a country and that borders do and should exist. If you are an open-border person, move along, there’s nothing here for you.

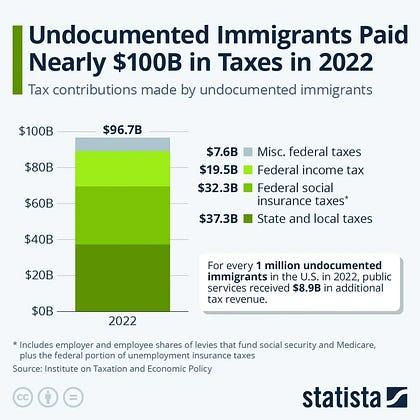

I ran across this graphic the other day. I love graphs, charts, tables, etc. Especially tax-related.

The data is interesting; the unstated argument, more so. What it is implying is that if you’re paying taxes, it doesn’t matter how you entered the country. Taking it to its logical conclusion, if you’re paying taxes, the rules (the law) don’t matter.

It doesn’t say that outright because, well, nobody in their right mind would make that argument.

Imagine arguing that shoplifters who donated a portion of what they stole to charity should be left alone. Ridiculous!

Perhaps I’m being unfair. Perhaps the steelman argument is that “illegal immigrants” contribute to society. That’s fair, but why do we care? I mean, obviously, paying taxes is better than not paying taxes, but what does this have to do with whether it’s ok to sneak into the country? This might be a good argument for making legal immigration easier, but is that the argument that’s being made?

A closer look at the text associated with the graphic shows the answer is “no:”

“The report states that more than a third of the tax dollars paid by undocumented immigrants went towards payroll taxes dedicated to funding programs that these workers are barred from accessing.”

No, the takeaway here is that illegal immigrants are not being treated fairly. “Illegal immigrants are paying taxes, and they’re not even benefiting from them. That’s not right!” Sorry, but if you’re going to argue that we should turn a blind eye to people sneaking into the country, please don’t try the “it’s not fair” argument with me. Is it fair to the people following the immigration process that cheaters can ignore the rules, suffer no consequences, and then get access to government services while most immigrants are foolishly following the rules?

Once again, there is no clear argument, but we can infer from what is being written that the goal is amnesty and access to government-funded services. Amnesty is another argument I’m not opposed to. In fact, I’ve actually made the case myself on this very site.

But good faith arguments require honesty, and this entire graphic reeks of dishonesty. If you have an argument, make it clear. While you’re at it, make the data clear as well.

$96.7 billion sounds like a lot of money. And it is, if we were talking about an individual. But we’re not, we’re talking about Federal, State, and local governments. The Federal government alone collected $2.6 trillion in taxes from individuals in 2022. $19.5 billion, even if accurate, represents 0.75% of the total. It’s a rounding error.

Focusing on monetary contributions made by illegal immigrants is irrelevant. In logic and rhetoric terms, the practice is known as the ignoratio elenchi fallacy (Latin for “ignoring the refutation”). You and I know it as a red herring, a distraction that shifts attention to something irrelevant.

How do we know it’s a red herring? Because the graphic isn’t showing how much taxes immigrants pay, it’s how much illegal immigrants pay. The argument is focused entirely on illegals. Here is an interesting piece of information that the graphic doesn’t mention: according to a 2023 Pew Research poll, unauthorized immigrants made up 27% of all U.S. immigrants. That means that 73% of immigrants are legal immigrants. Now, I realize many don’t like the term “illegal,” preferring “undocumented” instead, since “no human is illegal.”

Fair enough. However, if that’s the case, then no human is legal either, so we’re going to need a new term for “legal immigrant.” I’ll agree to use the term “undocumented immigrant” if we can come up with a more honest label for the 73% of immigrants who follow the rules. How does “documented suckers” sound?

What else would you call someone who waits in line when they don’t have to?

Phil is a freelance writer, Canadian Navy veteran, and classical liberal. He has lived and worked in both Canada and the United States and currently resides in Vancouver, British Columbia where he writes on politics, individual rights, free speech, and anything else that catches his fancy.

If you enjoyed this article please consider sharing your thoughts in the comments, subscribing, or even buying him a coffee if you’re feeling generous and felt that this was a particularly enjoyable article. Your attention, participation, and support really make a difference to us.

Wrong Speak is a free-expression platform that allows varying viewpoints. All views expressed in this article are the author’s own.

Note also that the vast bulk of this number is payroll taxes - i.e. taxes that would be paid by any person doing this job. These aren’t extra tax revenues we magically get because these people are here, they’re the exact same tax revenues we would be getting if the job was held by a citizen or legal immigrant (or possibly lower if the illegal is being paid below market wages), but with the added benefit of there often being stolen SSNs and fraud that affects citizen victims involved!

I used to think amnesty made sense. Then it became clear that the woke would use it as a method for open borders. I can even tolerate open borders, but not benefits for anyone in the world who fancies them. Which appears to be the goal.

It would be much more simpler if the left were honest about their own opinions.