Wealthy individuals often choose to invest in the stock market rather than keeping their money in traditional bank accounts. This preference is driven by several key factors, including higher returns, tax advantages, and protection against inflation. To fully understand these motivations, it's essential to explore the investment vehicles commonly utilized by affluent investors, such as hedge funds, mutual funds, and exchange-traded funds (ETFs).

Understanding Investment Vehicles

Hedge Funds

Hedge funds are sophisticated investment vehicles that employ diverse strategies to achieve high returns. These funds are typically accessible only to accredited investors due to their complex nature and higher risk profiles. The concept of the hedge fund was introduced in 1949 by Alfred Winslow Jones, a sociologist and financial journalist.

Jones pioneered the strategy of short selling, where an investor borrows shares and sells them, anticipating a price decline to repurchase them at a lower cost later. This approach allows hedge funds to profit in both rising and falling markets. However, hedge funds often come with high fees, commonly charging a 2% management fee and 20% of profits, known as the "two and twenty" structure. Additionally, regulatory limitations often cap the number of investors in a hedge fund to 99.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities. They cater to various investment objectives, including growth, income, or value investing, and can focus on specific sectors or regions, such as European or Asian markets. Mutual funds offer investors access to a broad range of assets, including stocks, bonds, and commodities like gold and silver. One characteristic of mutual funds is that transactions are executed at the end of the trading day, meaning buy or sell orders placed during the day are processed at the fund's closing net asset value (NAV).

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they offer diversified exposure to various asset classes. However, unlike mutual funds, ETFs trade on stock exchanges throughout the trading day, allowing investors to buy and sell shares at market prices in real-time. This intraday trading flexibility makes ETFs a popular choice among investors seeking liquidity and real-time pricing.

Reasons Wealthy Individuals Prefer Stock Market Investments

Higher Returns

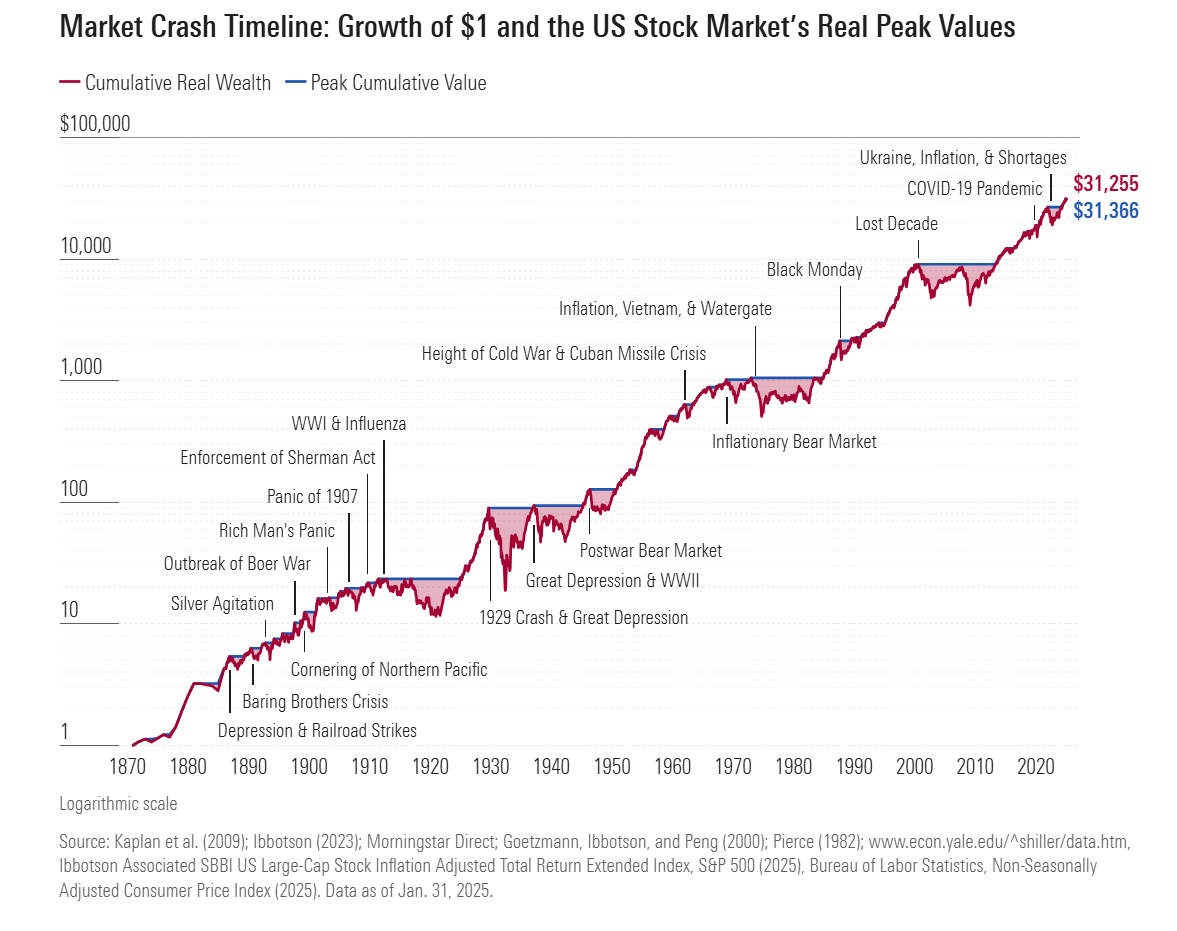

One of the primary reasons affluent individuals invest in the stock market is the potential for higher returns compared to traditional bank accounts. While bank savings accounts offer security and liquidity, they typically provide modest interest rates, often around 5%. In contrast, the stock market has historically delivered higher returns over the long term. For example, the S&P 500 index, which tracks 500 of the largest U.S. companies, has averaged annual returns of approximately 10% over the past several decades.

Tax Advantages

Investments in the stock market can offer significant tax benefits. Qualified dividends and long-term capital gains (profits from assets held longer than a year) are taxed at lower rates, typically ranging from 0% to 20%, depending on the investor's taxable income. In contrast, interest income from bank accounts is taxed as ordinary income, which can be as high as 37% for high-income earners. This disparity in tax treatment means that stock market investments can result in more after-tax income, enhancing the compounding effect over time.

Inflation Protection

Inflation erodes the purchasing power of money over time. Traditional bank accounts, with their fixed interest rates, may not keep pace with inflation, leading to a loss of real value. In contrast, the stock market has historically outpaced inflation, as companies can adjust prices and revenues in response to inflationary pressures. This ability to grow earnings over time makes equities a more effective hedge against inflation.

The Role of Investment Strategies

Long-Term Perspective

Wealthy investors often adopt a long-term investment horizon, allowing them to weather short-term market volatility and benefit from the compounding of returns. This approach aligns with the philosophy of renowned investors like Warren Buffett, who advocates holding investments "forever" to maximize growth.

Leveraging Investments

Affluent individuals can leverage their investment portfolios by borrowing against their assets, known as margin lending. This strategy allows them to access funds for other investments or expenditures without liquidating their holdings. The interest paid on margin loans is often tax-deductible, providing an additional tax advantage. For example, borrowing against a $100,000 stock portfolio to purchase a $40,000 asset can result in tax-deductible interest payments up to your taxable interest for the year. Any additional margin interest can be carried over to the next year. A traditional loan for the same purpose may not offer such benefits.

Case Study: Warren Buffett's Investment Philosophy

Warren Buffett, one of the most successful investors in history, exemplifies the principles that attract wealthy individuals to the stock market. Buffett emphasizes investing in businesses he understands, seeking companies with strong competitive advantages, and maintaining a long-term investment horizon. His approach underscores the importance of patience, discipline, and a focus on intrinsic value, all of which contribute to sustained wealth accumulation.

Wealthy individuals prefer stock market investments over traditional bank savings because of the pursuit of higher returns, tax efficiencies, and protection against inflation. By utilizing investment vehicles such as hedge funds, mutual funds, and ETFs, and employing strategies like long-term investing and leveraging assets, affluent investors can enhance their wealth while mitigating risks.

Understanding these factors provides insight into the financial decisions of the wealthy and highlights the potential benefits of stock market investments for long-term wealth accumulation.

Wrong Speak is a free-expression platform that allows varying viewpoints. All views expressed in this article are the author's own.

Thanks. This was really helpful.

I’m in a decision situation right now and found these concise explanations to be well-timed and clear.

It’s also hard to understand why it matters until somebody has a decent amount of money to invest. Otherwise, the gains and losses seem trivial.