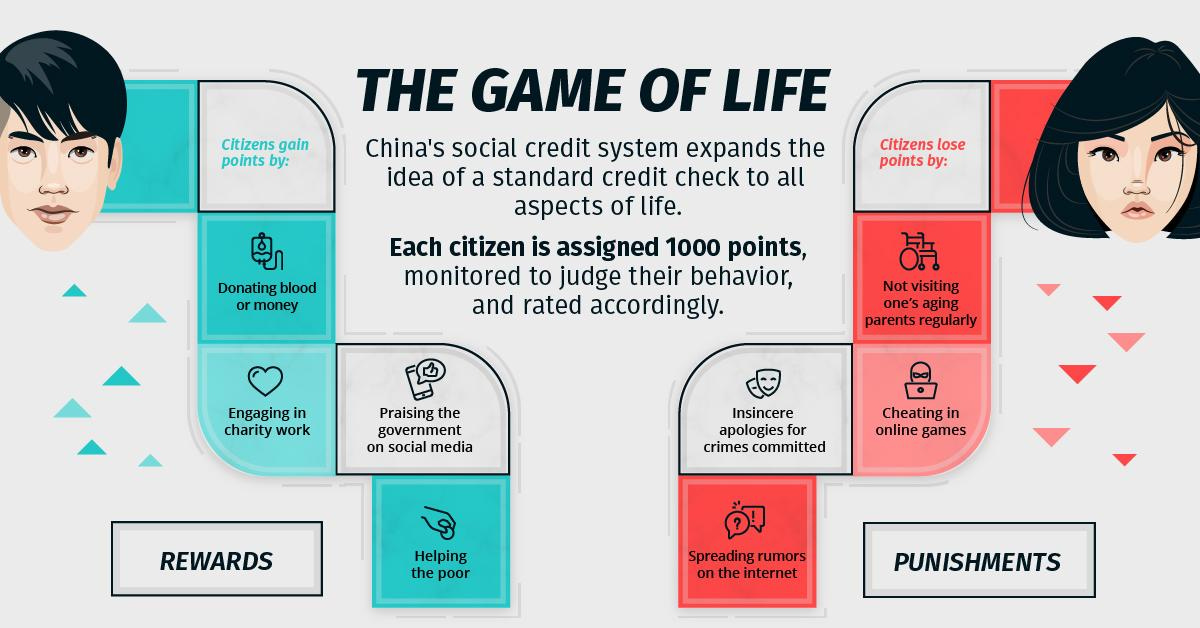

A few weeks ago, I described a world in which the government tracks every penny you spend and restricts what you can buy based on your spending habits or its social agenda. Today we examine a tool that when combined with a digital currency makes an authoritarian’s dream come true, social credit systems.

One of the many Orwellian episodes of “Black Mirror…

Keep reading with a 7-day free trial

Subscribe to Wrong Speak Publishing to keep reading this post and get 7 days of free access to the full post archives.