The word affordability is taking center stage as the latest political buzzword, and we see it everywhere. The narrative that affordability is driving the political dialogue these days reflects the public’s unhappiness with the cost of living. Unhappiness with the cost of living suggests that Trump has failed to dent the inflation driven by the Biden administration.

Nov 2025 — an article reports that many Americans cite groceries as their top “affordability” concern.

Nov 2025 — an article mentions that Trump is adjusting his message on the cost of living (addressing affordability)

Nov 13, 2025 — White House considers 50-year mortgage to ease home affordability crisis

Dec 3, 2025 — Donald Trump Calls the Word ‘Affordability’ a ‘Democrat Scam’

Dec 4, 2025 — The Affordability Crisis Is Hitting Wealthy Americans Now, Walmart, Dollar Store Earnings Show

Dec 4, 2025 — Democrats target Trump’s affordability crisis

To try and gain an understanding of affordability as an issue, we’re going under the hood and see what’s going on from an investor/economist’s view of the economy.

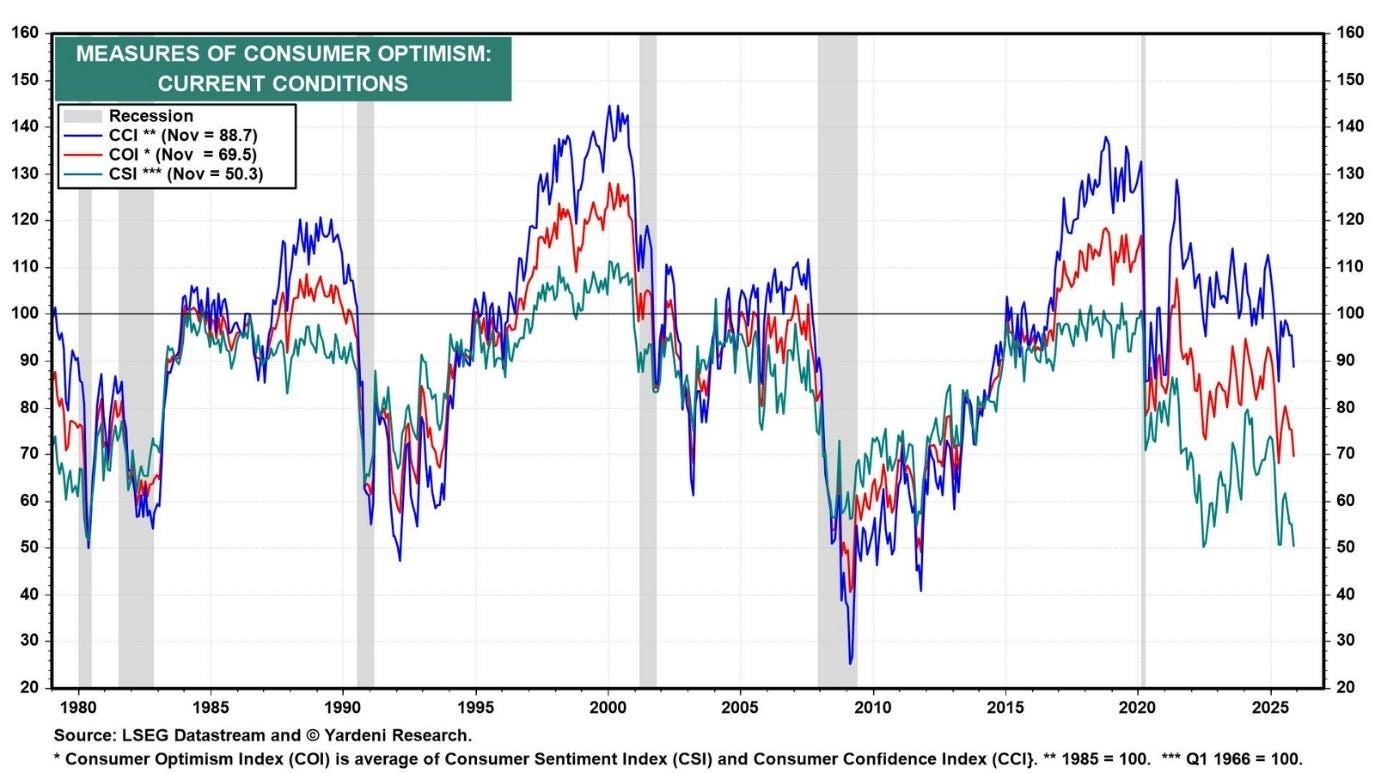

The federal government publishes data that helps us understand affordability. There are three main indices in their models: the consumer confidence index (CCI), the consumer sentiment index (CSI), and the misery index. The first one has two components: present situation (current business conditions and job availability) and future expectations (expected business conditions, expected employment, and expected income). The second index has five components: expected personal income, cost of major household items, personal income over the next 12 months, expected business conditions over the next 12 months, and expected business conditions over the next 5 years. The misery index is the sum of the unemployment rate and the inflation rate.

What should these indices be telling us?

The CCI tells us whether consumers are feeling secure, optimistic, and ready to spend, or cautious, anxious, and preparing to tighten their budgets. It functions as an early signal about economic turning points because consumer psychology often shifts before consumer behavior.

The CSI attempts to answer three psychological questions:

1. “How am I doing financially?”

2. “How is the economy doing?”

3. “What do I expect the economy and prices to look like soon?”

Together, these insights make the CSI an emotionally-driven signal—sometimes more volatile but often more predictive than broad economic indicators.

The chart above shows THE CCI and CSI over the last 50 years. COI (consumer optimism index) is the average of the two.

CCI has steadily dropped since 2020, but remains high relative to the past 50 years. CSI is very low, significantly below the COVID years and near the level of the Great Recession period.

Why would that be?

The divergence between CCI and CSI is confusing. CCI predicts labor market conditions, and CSI predicts future inflation. People seem to think the economy will continue to do well, but they are worried about inflation. They have carried this worry since the Biden years, when inflation peaked, and can’t seem to shake it.

The third index we mentioned is the Misery Index, which combines unemployment and inflation. It should be obvious to all that if either or both are high, the American people will suffer. The current Misery Index is a relatively low 7.4. It has averaged nine since the 1940s.

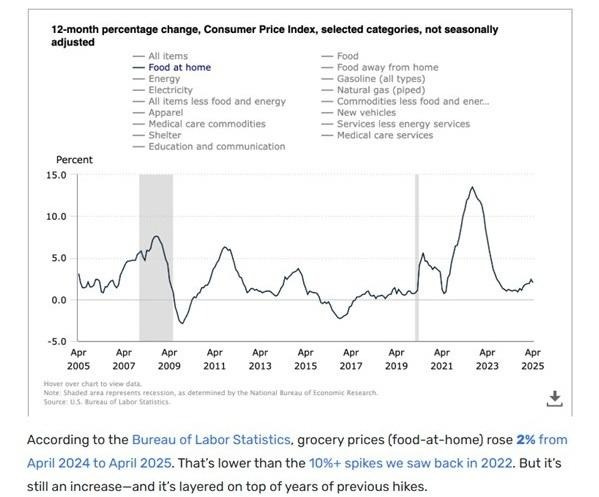

There is a reality behind the public’s worry about inflation. It shows itself if we use grocery prices as a measure of affordability.

The major causes of food price disruption include global supply chain and climate disruptions, labor shortages and higher wages, corporate pricing strategies and shrinkflation, and ongoing economic instability.

Even though inflation has decreased, prices are still high.

To me, there is a psychological factor contributing to public attitudes toward affordability: the state of American society, which is beset by social problems.

It starts with our tribal state, which has been with us for 15 years. The political parties have radically different agendas, and right now, Trump is trying to slow down America’s march to the left. That means disruption, because there is no other way to make changes. To many, the disruption is Trump’s power grab, rather than a leveling of ideologies.

We are still dealing with the inflationary aftereffects of COVID, along with the corruption of social media and threats to free speech. Our educational system is in shambles, and there is no trust in the government. That’s enough to make the American public miserable, separate from the affordability issue.

Affordability as a political issue is a trial balloon for Democrats to explore as a campaign theme for 2026 and 2028. They’re trying to find a middle-class issue they can exploit to reverse their alienation of the middle class that resulted from their adoption of a radical ideology.

Trump sees this and understands he has to directly address affordability with programs designed to benefit the American people. He is limited in what he can do, however, because many economic inputs are beyond his control. These factors include macroeconomic forces, corporate behavior, global trade, and geopolitics.

Trump calls the Democratic criticism over affordability a Democrat scam; a dangerous position, because there is no greater reality than an American family’s strained pocketbook.

Whenever the American people are hurting, they blame the guy in charge. But Trump faces a challenge no other president has ever faced. As the first populist president, he was clearly elected by people who believed in his ability to break the establishment’s hold on government policy and help them. That sets a high bar for results. If Trump doesn’t adequately address affordability by the fall, his party will see its punishment on Election Day.

Wrong Speak is a free-expression platform that allows varying viewpoints. All views expressed in this article are the author’s own.