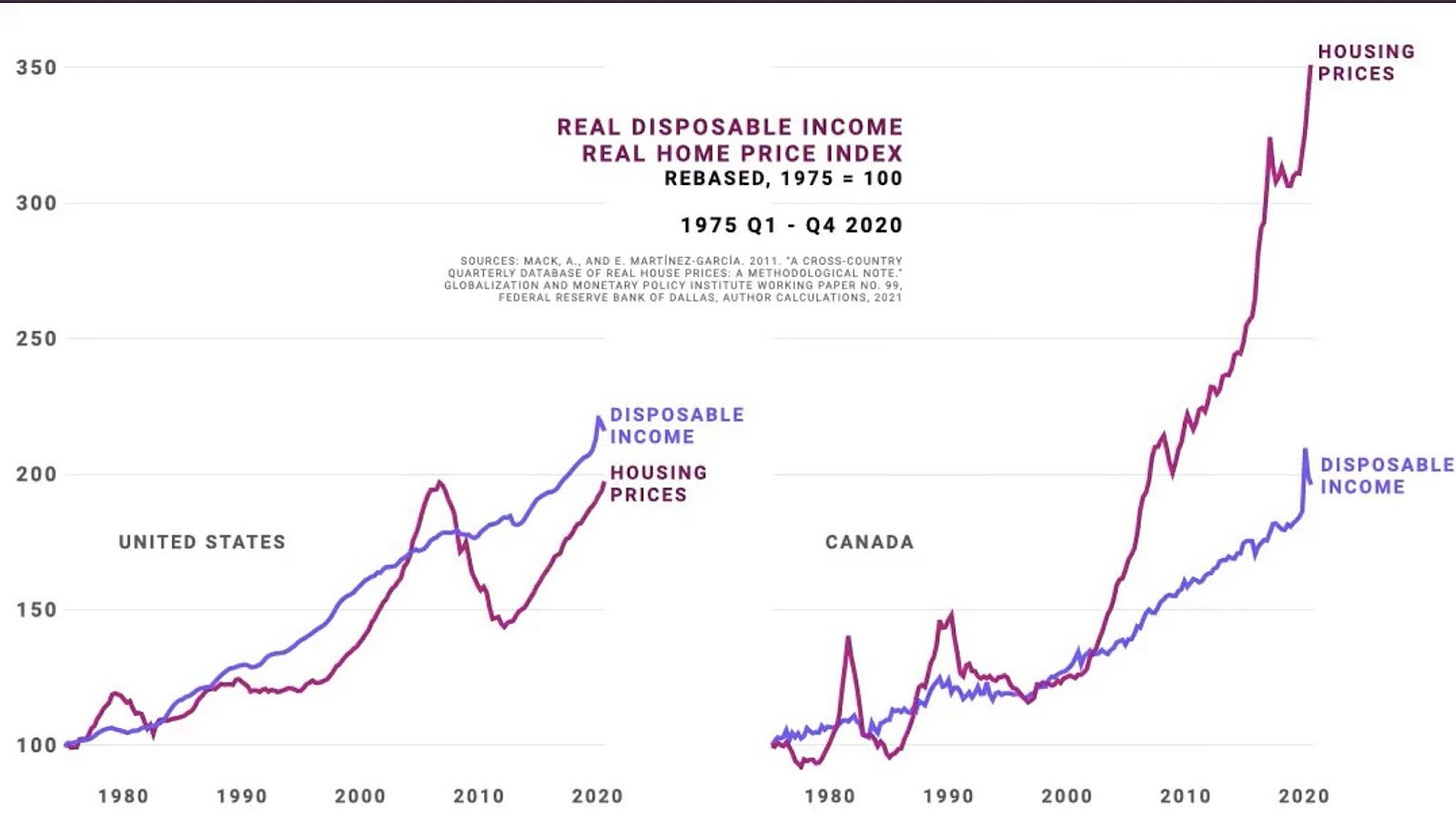

The American subprime mortgage crisis, which contributed to the 2007-2008 Global Financial Crisis, was triggered by the collapse of a housing bubble and led to a significant decrease in the price of US houses. While the crisis was global, it left Canadian home prices relatively unscathed, as the two graphs below show:

Canadian housing prices showed a …